The Property and Casualty Insurance Value Proposition

It is becoming essential for property and casualty insurance incumbents to reimagine the customer

value proposition and transform their aging product-service portfolios. This is the foundation for

value-chain transformation, something that agile disruptors continuously focus on, but where legacy

players have failed to do so.

There is immense opportunity for P&C insurance companies to develop and implement new strategies

designed for the digital era. Surprisingly, a large majority of these companies sit outside the

vision-driven quadrant in their approach to digital transformation. There is a growing sense of

urgency in the industry with a goal of digital transformation through continuous action. Still,

incumbents have yet to demonstrate significant action in this regard.

Only 7% of Companies Are Delivering on Their Transformational Initiatives

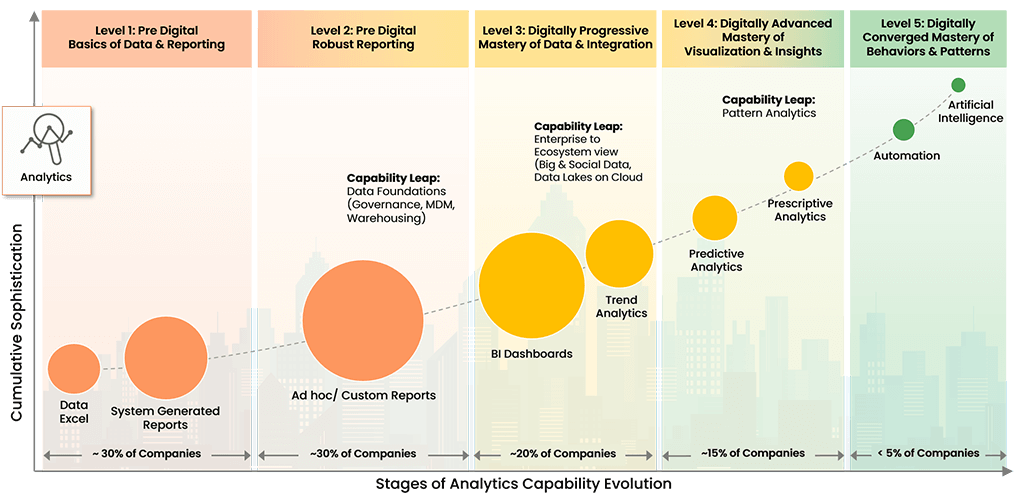

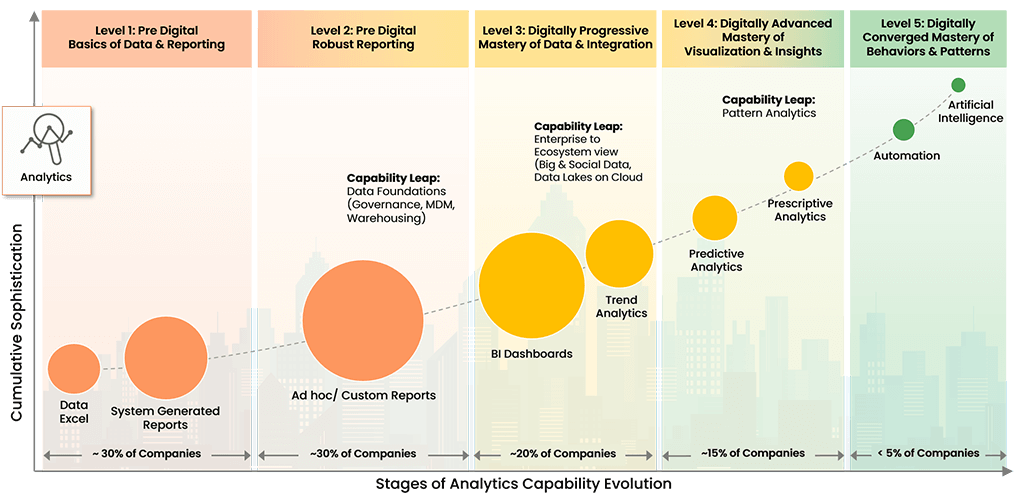

Our research has shown that 30% of companies will fail to survive this decade due to an inability to

evolve digitally. To address this negative trend, we have developed the Digital Enterprise Evolution Model™ (DEEM).

Digital Enterprise Evolution Model™

Copyright © 2022 Trianz

DEEM allows our clients to recognize digital evolution patterns, implement benchmarking and

prioritization strategies, and initiate application management protocols to satisfy stakeholder and

market requirements.

Property and Casualty Insurance Value Chain Reinvention

For property and casualty insurers, the value chain must shift away from product-service delivery.

Instead, it must focus on improving the customer experience (CX), as this is a proven way to retain

customers and sustain revenues. Part of this shift should include more focus and attention on weather or

climate patterns. Incumbents and disruptors alike must start learning and understanding how these events

can impact insurance premium calculations or coverage to deliver a better customer experience.

For consumers, this would involve greater preventative action and asset protection, with self-protection

resulting in lower premiums through data aggregation and analysis by property and casualty insurance

companies. All companies must integrate these capabilities into the product-service portfolio to retain

and reward customers.

Human Capital Management (HCM) in the Property and Casualty Insurance Industry

Property and casualty insurance companies are failing to leverage human capital management (HCM)

effectively. This is resulting in an inability to acquire new or keep existing talent, with said talent

being vital in such a tightly regulated and complex industry.

Human resources (HR) is the area with the highest planned investment in digitalization. This investment

includes process digitalization and robotic process automation (RPA) to transform the efficiency and

throughput of HR workflows and processes.

Digital-first startups are incredibly attractive to long-term career workers in the insurance industry,

offering a breath of fresh air in terms of culture and innovative product-service portfolios. Incumbents

must compete with disruptors by improving the employee experience (EX), becoming more technology-centric

to attract and retain talent. Furthermore, increased personal involvement, evangelization, and

transforming talent through training will be essential in building the digitally savvy insurance

workforce of the future.

Experience the Trianz Difference

Trianz enables digital transformations through effective strategies and excellence in

execution. Collaborating with business and technology leaders, we help formulate and execute

operational strategies to achieve intended business outcomes by bringing the best of

consulting, technology experiences and execution models.

Powered by knowledge, research, and perspectives, we enable clients to transform their

business ecosystems and achieve superior performance by leveraging infrastructure, cloud,

analytics, digital and security paradigms. Reach out to get in touch or learn more.