Making Life Easier With Better Data

Compared to other sectors, the life insurance industry has been hesitant to embrace digital change. Many companies in this line of business still rely on an outmoded sales process that follows the legacy broker-to-consumer model. This approach fails to empower customers to make their own decisions and act as participants in the process. Such a failure to meet the expectations of the modern consumer puts traditional life insurance companies at risk of losing their market share to a more future-ready competition.

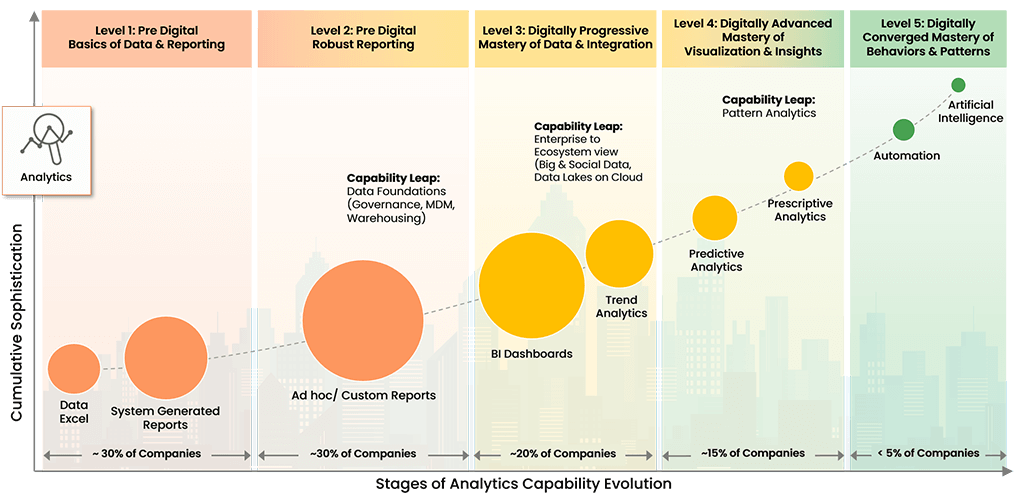

But it’s not too late. By acting now and investing in advanced analytics, life insurance companies will gain a significant advantage in terms of customer intimacy, product-service portfolio reinvention, and cost optimization.

Still, it will require more than just action on the part of traditional organizations who are looking to modernize their business approach. These companies must not only act but act intelligently. Our data demonstrates clear vulnerabilities among companies that sit outside the vision-driven quadrant. For life insurance companies that make errors in their digitalization approach, they still risk falling behind digital disruptors as consumer lifestyles change.