Reimagining the Health Insurance Value Proposition

Product-service portfolio innovation is the most urgent challenge with value-chain reinvention in the health insurance industry. Insurance companies will need to invest and forge partnerships with pharmaceutical or medical device manufacturers, driving better understanding of medical advancements to deliver better product-service experiences. Particularly, demographic analysis and the efficacy of therapeutics in this context will be crucial in enabling preventative and predictive insurance solutions. This can be done with advanced analytics adoption as well as remodelling the end-to-end service chain through digital transformation.

Investment in analytics will assist insurers in building accurate risk models, driving product-service innovation, and re-engineering customer engagements. This will transform health insurance from a coverage-based industry into a partnership-based industry between insurers, providers, and patients. The end goal should be delivering seamless full-spectrum care services, with minimal administrative error and streamlined billing or coding processes.

Only 7% of Companies Are Delivering on Their Transformational Initiatives

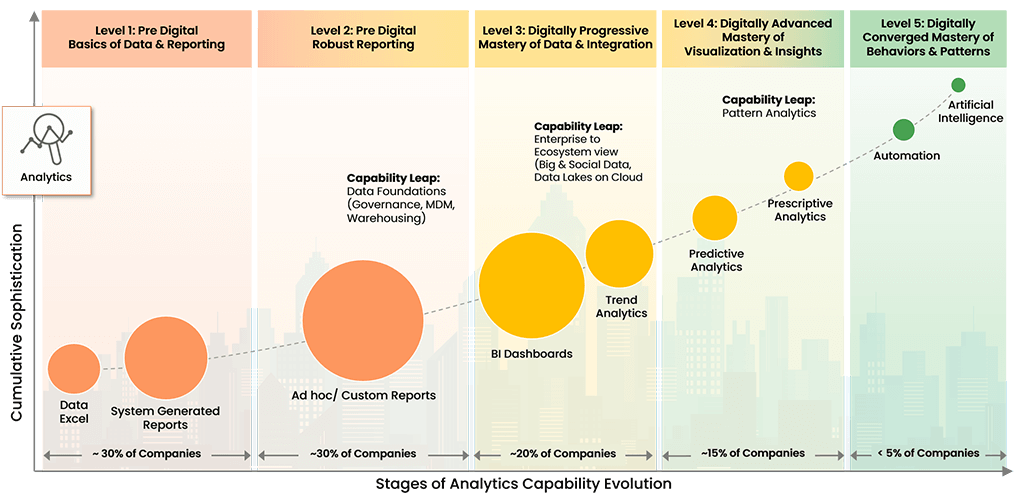

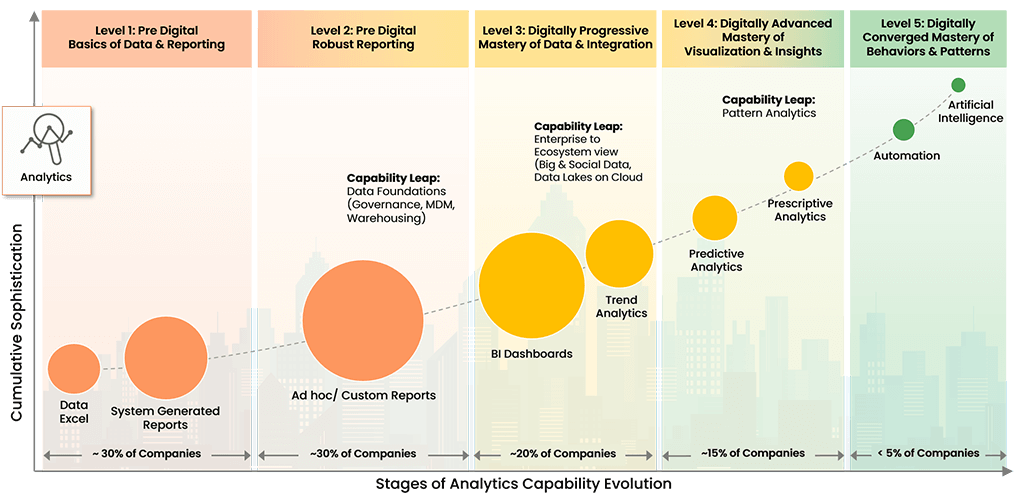

Our research has shown that 30% of companies will fail to survive this decade due to an inability to evolve digitally. To address this negative trend, we have developed the Digital Enterprise Evolution Model™ (DEEM).

Digital Enterprise Evolution Model™

Copyright © 2022 Trianz

DEEM allows our clients to recognize digital evolution patterns, implement benchmarking and prioritization strategies, and initiate application management protocols to satisfy stakeholder and market requirements.

Health Insurers Outside the Vision-Driven Quadrant Are at Risk

Many health insurers sit outside the vision-driven quadrant for digitalization. This puts them at considerable risk. Most large health insurance companies have begun on their digital transformation journey — however, sub-optimal execution is undermining their efforts.

Research and development as well as product innovation are growing in importance, but the majority of health insurers are too preoccupied with cost optimization and minimizing expenditures.

Human Capital Management (HCM) Among Health Insurers

The health insurance industry is struggling to secure a position where customers recognize the value they add. This coincides with a lack of investment in human capital management, where the talent pool is simply too small and lacking in digital skills. The health insurance experience for consumers must be reimagined to create value, and customer-driven health insurance personnel will lead the charge.

Health insurers must create a global set of company values, transform the employee experience (EX), and enable better multi-channel communication to attract much-needed talent. CEOs will see immense benefits through benchmarking their health insurance operations — such as with the Trianz Digital Enterprise Evolution Model (DEEM™) — in addition to identifying actionable changes for product-service portfolios, reimagining the value chain, and reinventing the process of human capital acquisition and management.

Experience the Trianz Difference

Trianz enables digital transformations through effective strategies and excellence in execution. Collaborating with business and technology leaders, we help formulate and execute operational strategies to achieve intended business outcomes by bringing the best of consulting, technology experiences and execution models.

Powered by knowledge, research, and perspectives, we enable clients to transform their business ecosystems and achieve superior performance by leveraging infrastructure, cloud, analytics, digital and security paradigms. Reach out to get in touch or learn more.