Banking on the Next Big Idea

The financial services industry has an excellent track record in leveraging new technologies to drive operational efficiencies. However, it is also slow in introducing new digitalized products and services.

Only one-quarter of financial services companies are making investments in digitalization based on analytical insight. This industry still relies heavily on traditional partner relationships and legacy products or services that have fallen behind new and innovative digital services from disruptors.

Our data clearly shows vulnerability in financial services companies that sit outside the vision-driven quadrant. While long-term industry relationships offer false comfort and security, an undercurrent of new and innovative solutions from digital disruptors is quickly nullifying the value proposition for legacy financial services companies. As consumers catch on and adopt these new digitalized services, legacy companies will either be left behind or removed from the market completely.

A Quiet Digital Finance Revolution

The financial services industry is undergoing a quiet digital revolution. The Trasers(Trianz Research) Compass Guide demonstrates how 50% of smaller businesses and 25% of medium-sized businesses in the segment are born digital. This allows them to deliver more innovation, increase the level of customer intimacy, and drive convenience with digitalized services that are personalized to the customer. In fact, intimacy, convenience, and personalization are more important to consumers now than loyalty to a brand name.

Change in the financial services industry is fragmented across the retail investments, capital markets, brokering services, and wealth management sectors. However, the industry as a whole is formidable. Legacy financial services companies must maintain a high level of awareness and remain sensitive to shifting trends and sentiments, adopting new technology-driven business models and processes to retain industry leadership.

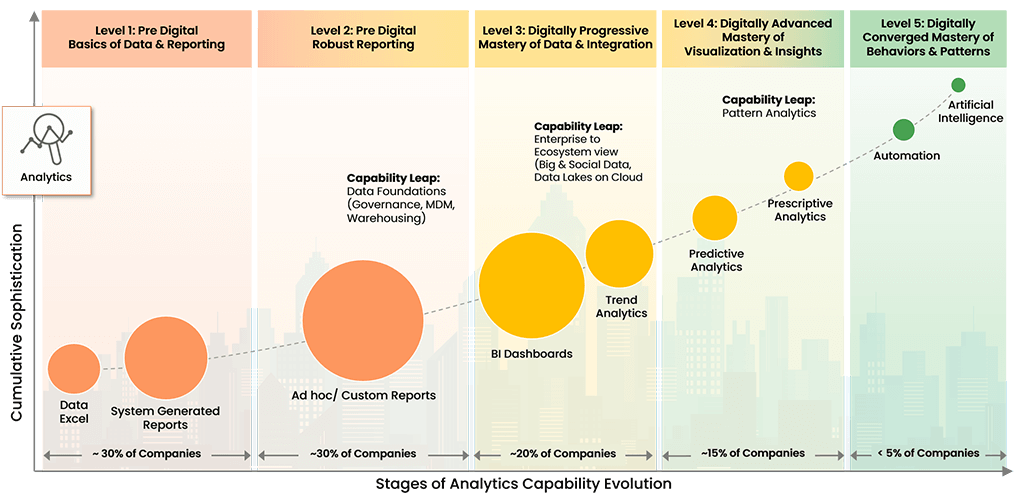

The Most Successful Digital Transformations Are Powered by Analytics Capabilities

Our benchmarking services are powered by over 1.5 million data points in addition to our primary research and data collection capabilities. With access to leaders across more than 40,000 companies in various size segments, industries, and geographic locations, we can quickly gather additional data to address how your business is performing against the competition.

Source: Trasers(Trianz Research)

Data analyzed in this report comes from 4,000+ responses. For the financial services industry, data from 262 companies have been used.

Our financial services industry experts can offer insights into the following sectors:

Depository and Non-Depository Credit Intermediation

Wealth and Asset Management

Capital Markets

Investment Banking

Private Equity

And More