Reimagining the Banking Services Customer Value Proposition

Reimagining the customer value proposition across the banking industry is essential for reinventing

the customer value chain. Cashless transactions are becoming more widespread, and this presents an

economic opportunity for disruptors with alternative business models that integrate digitalization

at its heart.

New digital banks are holistic and un-siloed, enabling a global ambition thanks to delocalization of

digital services. This is enabled through the cloud,

artificial

intelligence (AI) or machine learning (ML), and robotic process automation (RPA) technologies.

Incumbents lose their advantage in the face of these digital technologies, enabling disruptors to

provide innovative and holistic services to their customers.

While traditional banks have a safety net in the form of reputation, market presence, and regulatory

bias, these new business models are rapidly changing the banking landscape. Routine bank accounts

and ATM transactions will become obsolete, with digital-first service provision becoming the

priority for consumers. Current leaders must digitalize their internal operations and develop higher

levels of customer intimacy to brace themselves for this digital storm.

Only 7% of Companies Are Delivering on Their Transformational Initiatives

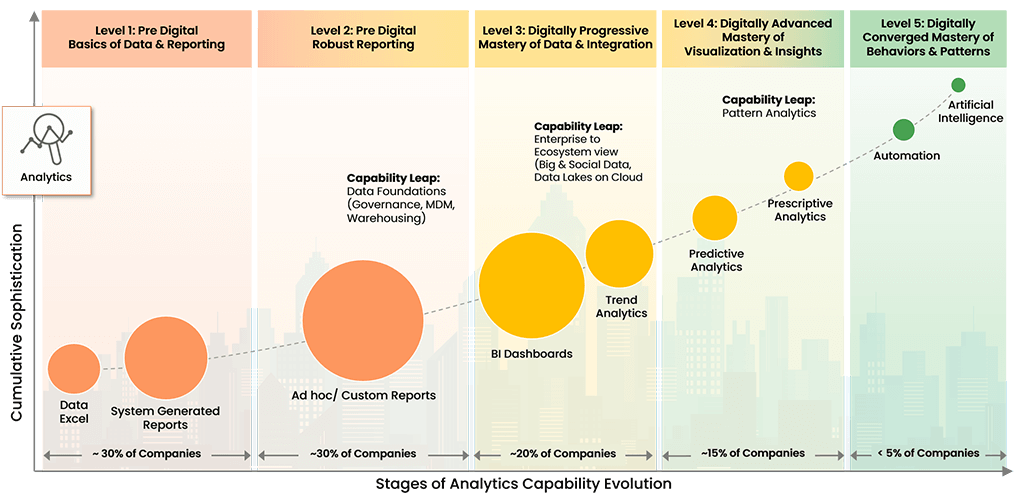

Our research has shown that 30% of companies will fail to survive this decade due to an inability to

evolve digitally. To address this negative trend, we have developed the Digital Enterprise Evolution

Model™ (DEEM).

Digital Enterprise Evolution Model™

Copyright © 2022 Trianz

DEEM allows our clients to recognize digital evolution patterns, implement benchmarking and

prioritization strategies, and initiate application management protocols to satisfy stakeholder and

market requirements.

Many Banking Firms Sit Outside the Vision-Driven Quadrant

There are a finite number of competitors in the banking industry. This increases visibility between

competitors, enabling combative innovation and proactive product-service development.

Still, most banking firms sit outside the vision-driven quadrant, putting them at significant risk in the

face of digital disruption. This demonstrates a lack of urgency among banks; despite large players

reporting significant investments in digitalization, sub-optimal execution of digital transformation

roadmaps is undermining their efforts.

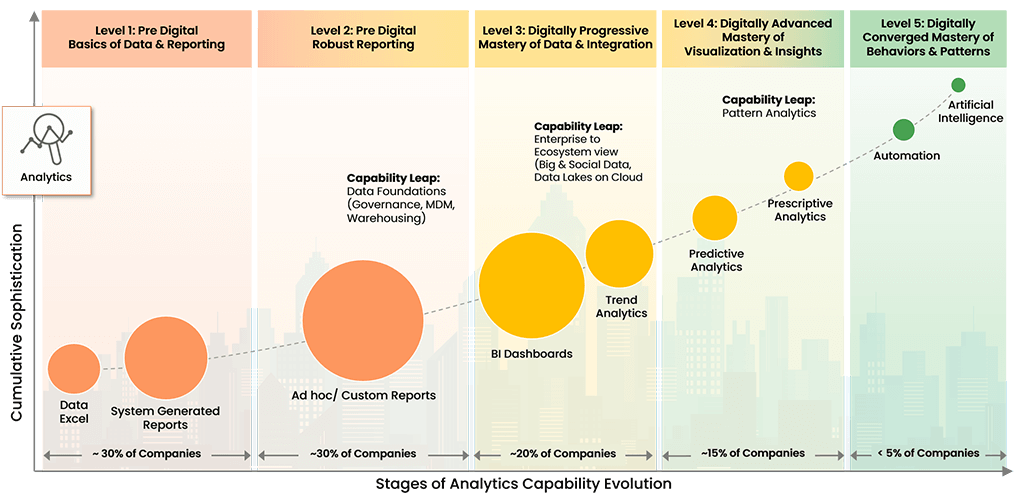

Many banking companies report large investments in advanced analytics and process digitalization,

including robotic process automation (RPA). There is still room for improvement for these firms when

developing an integrated strategic approach for the digital era.

Human Capital Management (HCM) in the Banking Industry

Future banking models must address the customer lifecycle, the emergence of cashless societies, and

include the development of innovative alternative banking products or services that go beyond basic

service provision.

To enable this, banking firms need talent. Human capital management is another area with large investment

from banks, where experience is vital to navigate this complex and highly regulated industry. The

largest investment in HCM is through digitalization of processes and the adoption of advanced analytics,

assisting with the acquisition and retention of banking talent for incumbents.

To enter the vision-driven quadrant, CEOs must seek to benchmark their operations and form comparisons

against leaders in the space. CEOs can benchmark their banking operations using models like the Trianz

Digital Enterprise Evolution

Model (DEEM™).

In summation, banks must focus on reinventing their product-service portfolios, catering better to

consumer expectations, and optimizing their workforce for better customer experiences (CX) and employee

experiences (EX).

Experience the Trianz Difference

Trianz enables digital transformations through effective strategies and excellence in

execution. Collaborating with business and technology leaders, we help formulate and execute

operational strategies to achieve intended business outcomes by bringing the best of

consulting, technology experiences and execution models.

Powered by knowledge, research, and perspectives, we enable clients to transform their

business ecosystems and achieve superior performance by leveraging infrastructure, cloud,

analytics, digital and security paradigms. Reach out to get in touch or learn more.